Turning Debt into an Asset for your Clients

How can advisors turn debt into an asset for clients?

Introduction

“A penny saved is a penny earned” noted Benjamin Franklin, and nearly every parent since, preaching the value of saving. As it was, old Ben might have missed the lesson on compounding interest - a penny saved is in fact two or more pennies earned over the right time horizon. Indeed, optimizing your client’s debt can be highly accretive to both their portfolio as well as your relationship with them.

Why should advisors manage their clients’ debt?

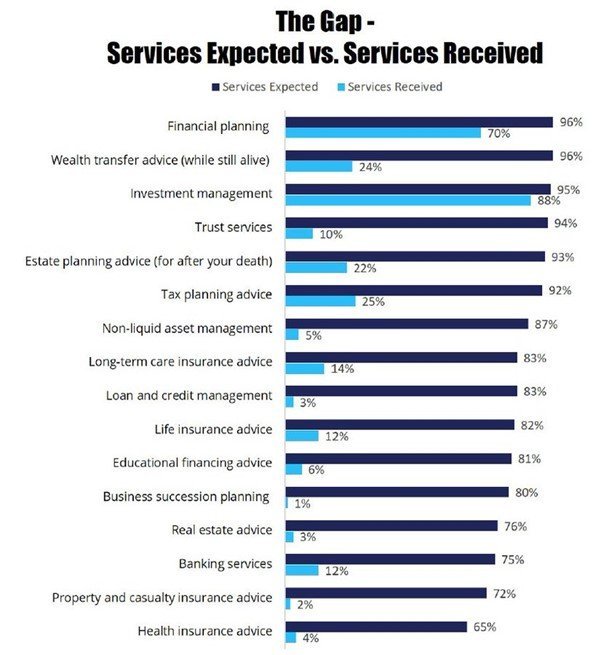

Clients are craving support for their liabilities and advisors who provide that support are highly differentiated. A research study conducted by the Spectrem Group in 2021 found that 83% of clients expected to receive loan and credit management services from their advisor while only 3% of advisors offered it. Managing client liabilities can be a tremendous way to attract new clients and retain existing ones. Delivering client value through multiple methods is critical, particularly when market volatility means that it is challenging to show your value in your clients’ investment portfolios.

Optimizing your client debt drives concrete and tangible value. Sora has seen this first hand by providing clients with unique ways to create meaningful dollars. One family we previously profiled was able to find $30k of savings opportunities on their home loan within minutes. Sora proactively found opportunity for another advisor’s client to reduce his medical school debt interest rate from 4.375% to 3.14%. The resulting monthly savings, if invested with his advisor, may result in a $20k+ net increase in his assets.

Managing client debt allows you to be proactive for your clients without increasing workload. Sora continuously monitors your clients’ debt and prevailing rates from lender partners so that when there’s an opportunity to save your clients money, we’ll alert you and make the execution process seamless. The best part is that there’s no extra work for you or your clients. Debt is one less thing for your clients to worry about, and you get to focus on the areas of investing and planning strategy that you know best.

Conclusion:

Whether you use Sora or manage your clients’ liabilities on your own, the benefits to both you and your clients are significant. Indeed, it’s all upside. The interest savings Sora finds for you to invest increase your AUM, without cutting into the lifestyle or “fun budget” of your client. Optimizing debt matters even more in new financings. When your clients take out a new loan for a home purchase, you can rest assured that Sora is keeping as many client dollars investable as possible, by finding the best financing rates and experience with our lender partners.

With Sora, you can turn debt into an asset for your clients. We’ll find the penny for you and you can turn it into two.